SECTORS

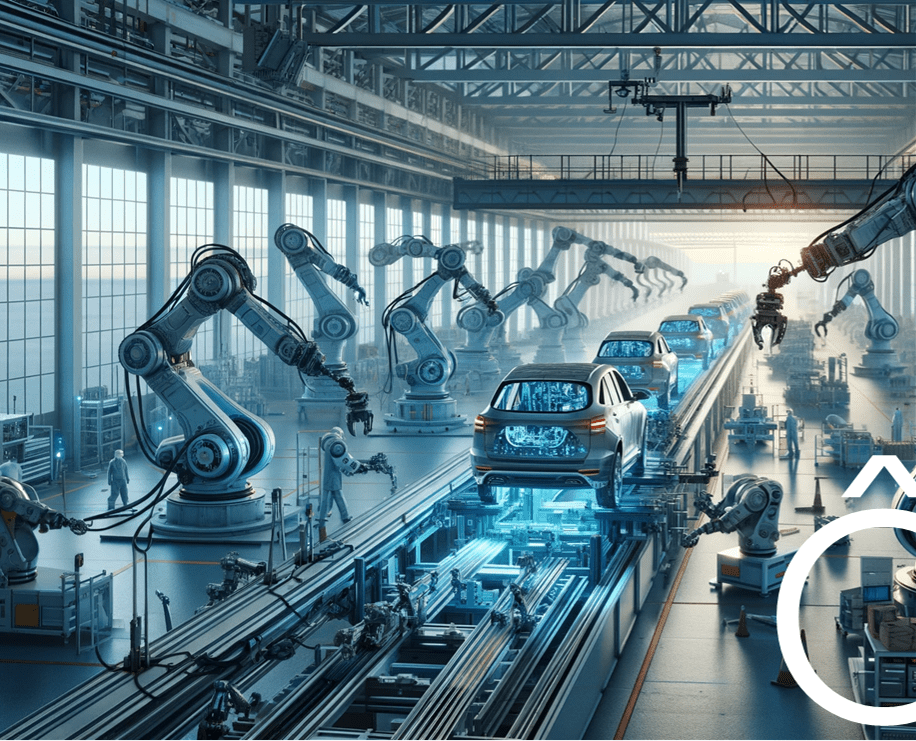

AUTOMOTIVE INDUSTRY

PÔNT AUTO business unit has partnered with a leading global automotive organization, giving us access to over 30,000 entities worldwide. This alliance enables us to serve as a buy-side and sell-side platform, facilitating transactions between key industry players in Mexico and internationally.

Mexico offers unique opportunities for global companies to enhance competitive advantages and market penetration. Key factors favoring the Mexican automotive sector include:

- Strategic Location: Proximity to the US and Canada under the USMCA.

- Competitive Manufacturing Costs.

- Free Trade Agreements (FTAs).

- Established Automotive Industry

FLEET LEASING AND MANAGEMENT

With its extensive global network, PÔNT is optimally positioned in the pure fleet leasing sector, where it has specialized for the last six years.

Rising interest in pure fleet leasing in Mexico and globally, with annual growth rates of 15% locally and a global CAGR of 7% to 8% by 2025.

Strategic value for Mexican and international companies.

Need for optimization and flexibility in transportation, allowing corporations like CEMEX, Grupo Bimbo, Amazon, and Rappi to access modern fleets without significant capital investment.

Growing demand underscores the pure leasing model's effectiveness in adapting to market changes and preferences for sustainable, energy-efficient solutions.

Pure fleet leasing fosters business growth and adaptability, marking a shift in asset management and promoting operational efficiency in a dynamic global economy.The above information is based on PÔNT research and reports on growth trends in the pure fleet leasing market in Mexico and globally. For deeper insights, consult sources like the Mexican Association of Vehicle Leasing Companies, the World Bank's IFC, the U.S. BEA, Ernst & Young, PwC, and industry reports from Automotive News, Fleet World, and the Finance & Leasing Association.

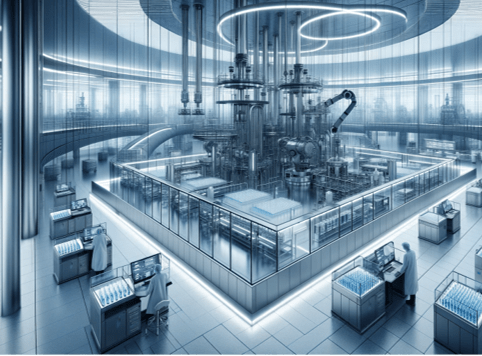

PHARMACEUTICAL AND LIFE SCIENCES

Global Network Access: PÔNT connects companies in the pharmaceutical sector with opportunities in mergers, acquisitions, private equity, and venture capital.

Competitive Edge: Our buyer and seller network allows companies to capitalize on expansion opportunities, enter new markets, and acquire innovative technologies.

Opportunities in Mexico: Recent regulatory changes in Mexico attract investments and promote innovation, enhancing the M&A environment and positioning Mexico as a gateway to LATAM.

Market Growth: In 2023, biopharma M&A deals increased by 80%, nearing $150 billion, signaling market consolidation and diversified investments.

Strategic Planning: Companies need a clear strategy, market knowledge, and efficient acquisition plans to capitalize on these opportunities.

Research-Based Insights: Based on PÔNT’s research and aligning with insights from PwC, EY, PhRMA, and McKinsey & Company.